This

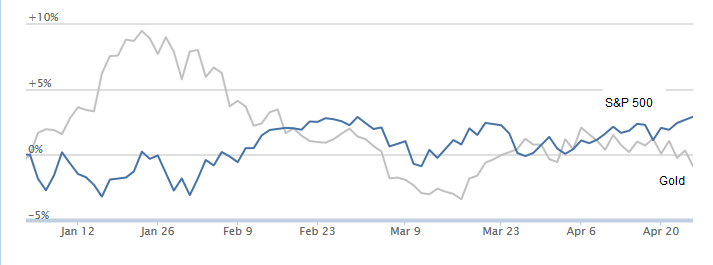

past week's seen the S&P500 leap almost 2% and gold fall more than 2%.

A couple percent may not seem like much but having it happen in just

five trading days means we got annualized returns of a 2/3 loss on gold

and 50% gain on stocks.

This

past week's seen the S&P500 leap almost 2% and gold fall more than 2%.

A couple percent may not seem like much but having it happen in just

five trading days means we got annualized returns of a 2/3 loss on gold

and 50% gain on stocks.

Weird how it is though that with stocks it means that we're now officially in a "confirmed uptrend", but for metals nobody says we're in some kind of downtrend. No matter.

What does matter is what we got right now and what we're doing about it. This market trend for stocks means something beyond "aw if only...", namely that a lot of folks are happy with 'em and Investor's Business Daily has a "how to" page with these topics.

So what this weeks stock rally means is in this page [from IBD: ...Market Direction, Key To Sound Trading... ]:

...the last element to remember is the M in CAN SLIM. It stands for market direction. Invest only when the market is in a confirmed uptrend.

The M also reminds investors not to fall into the bad habit of trying to forecast the market — not to get caught up in worrying over where the market is headed next week, next month, next year.

IBD takes a more here-and-now approach. The rules here are simple: Keep your investments to a manageable few. Pay close attention to each chart. Manage your investments according to the behavior of each individual stock.

And the M reminds you to pin the backdrop — the overall stock market. The tighter you dial in your attention to this type of stock tending, the more fascinating the lessons become.

The fastest, simplest way to follow the market is to read IBD's daily Big Picture articles.

These provide an overview of each day's market action, including a quick-glance status indicator, the Market Pulse.

The Big Picture doesn't try to tell you where the market will be six or 12 months from now. It counsels investors as to how aggressive or cautious they might want to be, given the market's current behavior.

A confirmed uptrend with institutional money moving into the market gives a risk-on signal. This frees investors to buy leading stocks breaking out past buy points, or to add to current holdings when stock charts provide follow-on opportunities.

A distribution day occurs when an index falls at least 0.2% in higher trade. This indicates unusually strong selling by institutional investors such as...

[snip]

* * * * * * * * * *

This is the thread where folks swap ideas on savings and investment ---here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy.