Hope everyone enjoyed their first quarter!

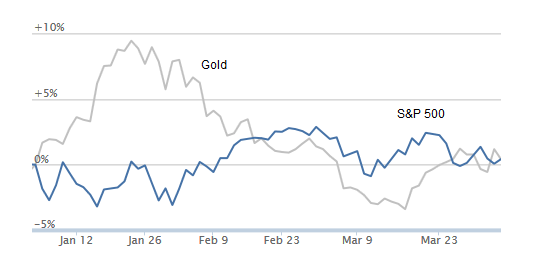

Not bad --not only have both gold and the S&P500 come out positive but the NASDAQ punched above 3% (annualized to more than 14%) but silver's come out 6% ahead -a 26% rate/year.

Market prices are great the way we can follow up-to-the-second reports, but for stats on the general economy we'll have to wait until the folks who're paid for being smarter than us are ready to make up their minds. What we got so far is that they say our earnings are up, our unemployment rate's down, and our first quarter consumer confidence is at long last to a multiyear optimistic high! .

So how come we keep hearing about the "official" zero percent GDP for this past quarter? I mean, we heard it from Zero Hedge (It's Official: Fed Sees 0.0% GDP Growth In The First Quarter), from CNN Money (Atlanta Fed Cuts Q1 Growth Estimate to Zero) and it's been hashed over on this related thread (NO April fools Joke).

Fact is that nobody seriously is saying Q1 GDP was flat and the Fed never said it was --"officially" or otherwise. It wasn't even merely the Atlanta Fed Bank saying it. What this was all based on was the raw data from one of the pages on the Atlanta Fed's webite showing how a computer model (which had been fed these numbers) somehow came up w/ 0.0% and was upgraded the next day to 0.1%.

Bottom line is we don't quite want to dump our life savings into "sackcloth and ashes" futures just yet.

There's an old calendar affect called "Sell in May and Go Away definded by Investopedia as:

A well-known trading adage that warns investors to sell their stock holdings in May to avoid a seasonal decline in equity markets. The "sell in May and go away" strategy is that an investor who sells his or her stock holdings in May and gets back into the equity market in November - thereby avoiding the typically volatile May-October period - would be much better off than an investor who stays in equities throughout the year.

However,

Mark Hulbert (Investing

guru predicts 12% rise in stocks over six months agr) is one of many

who don't go along.

Thomas

Aspray at Money Show (One

Seasonal Trend Investors Should Ignore)

goes

so far as to point out how for years now the second half's been no

slouch --averaging double-digit gains.

goes

so far as to point out how for years now the second half's been no

slouch --averaging double-digit gains.

Yeah, we don't know for sure what the second half of 2015 will be like yet, but what we do know right now is that the "sell in May" people have been doing poorly for several years.

That said this next quarter is still heavy on the uncertainty side, one major wild card that MichaelCorleone turned me on to was Middle East tensions and the Iran deal. He pointed out "...oil, the US Dollar, and defense contractors like Lockheed and Raytheon? Seems to me the ME just got a lot more dangerous, especially for Israel.";

All I can say is that I'll have to agree with our president when he said that "the Middle East is a problem that has plagued the area for decades."

Uh huh.

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy.