[excerpt

from

Stock-market crash of 2016: The countdown begins]

[excerpt

from

Stock-market crash of 2016: The countdown begins]Dow will

drop 50% as market replays 2008, 2000 and 1929. That will

translate into the DJIA crashing from today’s 18,117 down 50% to about

9,000. Ouch, the Dow crashing all the way below 10,000. Unimaginable.

Bulls will hate it. No wonder our brains tune out, turn off. Instead, we

prefer the happy talk that will just keep coming out of Wall Street and

Washington till the 2016 collapse. We’ll just keep denying reality ...

till it’s too late, and we suffer another $10 trillion loss is on the

books.

Deja vu 2000: irrational exuberance, dot-com technologies

Remember 1999. Just 16 years ago. Roaring hot “irrational exuberance.”

Renewed stock market mania. Wall Street was hot. Stocks roaring. Back

then investors demanded insane annual returns during the worldwide

millennium celebrations: the top 19 mutual funds had 179% to 323% annual

returns.

Yes, dot-com stockholders expected 100% plus returns on zero revenues...

[snip]

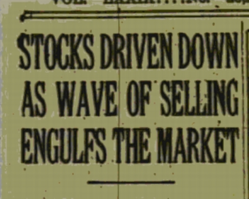

...Deja vu the Crash of 1929: and the long Great Depression...

[snip]

...Yikes, it took 13 long years to break even from Wall Street’s losses

of 2000 and 2008. And now investors are being warned that the Crash of

2016 will be even worse, with new losses of 50%. In short, the market

really is bad news.

But still, here we are again, panicking: Fearing that 2016 will repeat

1929, fearing that Wall Street and Main Street, tens of millions of

Americans, plus the Fed, the SEC, Washington politicians in both parties

will refuse to prepare for the Crash of 2016. Will deny hearing the

warnings ... of the Crash of 2016, one that promises in the end to

become bigger and badder and far more dangerous than 2008, 1999 and 1929

combined. Listen closely, the countdown to the Crash of 2016 has

started.

[excerpt

from Barron's rebuttal

Considering the ‘Stock Market Crash of 2016’]

[excerpt

from Barron's rebuttal

Considering the ‘Stock Market Crash of 2016’]DI’ll give

veteran MarketWatch columnist Paul B. Farrell his due: The man knows how

to draw clicks.

It’s hard to avoid an article with the headline: “Stock Market Crash of

2016: The Countdown Begins.”

While many seasoned consumers of financial journalism might be inclined

to dismiss an article with such a bombastic headline right off the bat,

I’m always willing to at least consider the arguments behind such a

claim.

If such a crash is a year off, it’s important to start preparing. A 50%

decline in stock-market value is a sharper drop than we endured in 2008.

Fortunately for long investors everywhere, there is little about the

article that should send anyone cashing out of stocks...

[snip]

...The bigger issue on trial here is the idea that investors should make

big asset bets based on bold market forecasts, whether by professional

money managers or journalists....

[snip]

...“Sure, they suffered steep losses (and likely lost some serious

sleep) as stocks cratered during the financial crisis,” Egan writes.

“Yet they also enjoyed a dramatic rebound in U.S. stocks as the system

stabilized. The S&P 500 is up over 200% since the bottoming out in March

2009.”

He adds that it may be tempting to stay on the sidelines. However,

holding too much cash for fear of a market crash will almost certainly

cause you to miss extended periods when markets perform well.

More

precision confusion from experienced professionals:

More

precision confusion from experienced professionals: