|

The Fiscal Times

January

30, 2015

With the first month of the new year coming to a close, it's clear that 2015 is shaping up to be quite different from the smooth, easy climb investors enjoyed in 2013 and 2014. As recently as late December, the market optimism seemed indefatigable as stocks powered to new record highs on hopes for new stimulus from the European Central Bank, solid U.S. economic data and a strengthening tailwind to consumer spending from the collapse of energy prices. Now, four weeks later, the sky has darkened. Stocks have returned to their mid-December lows, with a retest of the October lows — which represented the most severe selloff since 2011 — looking likely. Why? First, investors are losing faith with the lynchpin of this bull market: The belief in the omnipotence of the world's central bankers. Plus, Greece is riling up the global financial establishment once again. Corporate profits and outlooks have included some serious disappointments as oil keeps falling to fresh lows and currency market volatility depresses the value of repatriated foreign earnings. [snip] On top of all that, a weaker-than-expected U.S. durable goods report suggested that the slowdowns in Europe and Asia might be having an effect here at home. Orders dropped 3.4 percent in December, marking the fourth consecutive contraction and the worst reading since August.

|

In 2012 and 2013, the market uptrend rose

out of the ashes of the fiscal cliff scare and relief over

the results of the last Greek election, with plenty of help

from global central bankers who locked arms and unleashed a

wave of stimulus. ECB chief Mario Draghi made his "whatever

it takes" promise in July 2012. The Federal Reserve unveiled

its "QE3" bond-buying program that September. And "Abenomics"

kicked in after Japan’s December 2012 election, with the

Bank of Japan unleashing the most aggressive use of cheap

money stimulus so far, including the purchases of both

stocks and bonds. [snip] Drags include the impact of the stronger dollar on foreign profits, overseas weakness and the drop in energy prices. Although these factors were known heading into the reporting season, the actual impact on results has been more severe than expected, shattering expectations — formed by years of seemingly unstoppable corporate profitability — that results would always and forever surprise to the upside. According to FactSet, S&P 500 earnings per share growth expectations for 2015 stand at 4.9 percent, down from 8.6 percent earlier this month. Moreover, expected revenue growth has been cut in half to 1.5 percent. [snip] In response, I've recommended clients embrace a more defensive posture including long bets on volatility. For the more conservative, consider simply raising the cash allocation in your portfolios. |

|

* * * * * * * * * * * * * * * * * *

This piece originally caught my eye because it made some sense: seems to me like the investment markets are not going anywhere. While metals are failing to climb from their bases the major stock indexes sink below their 50-day moving averages and IBD keeps calling it 'market under pressure' as the distribution days pile up. So Mirhaydari's take satisfied my need for a daily dose of doom'n'gloom.

OK, lets think about this.

Maybe someone can help me but what I'm getting here is

that that the world's in turmoil, the economy's underachieving, and stock valuations are bearish. At first glance

it's convincing and then I try and think of when was the last time

the world was not in turmoil or when was the economy ever

overachieving? We're down to stock valuations.

underachieving, and stock valuations are bearish. At first glance

it's convincing and then I try and think of when was the last time

the world was not in turmoil or when was the economy ever

overachieving? We're down to stock valuations.

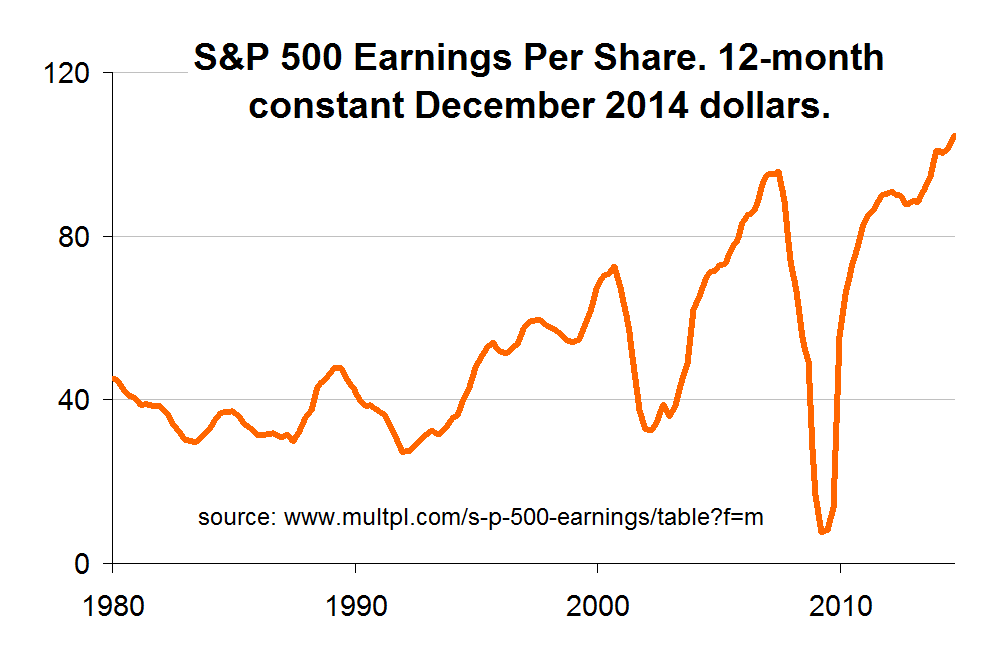

The writer hangs his hat on "S&P 500 earnings per share growth expectations" and in this wonderful info-age we can check it out for ourselves. This site has the historical numbers and a look at the past and yeah, EPS's are in fact stalling like they did back in the dot.com days and in mid '08.

Looking harder I'm also seeing that failing 'growth expectations'

really don't help much as a predictor of worse investment returns

in the future.

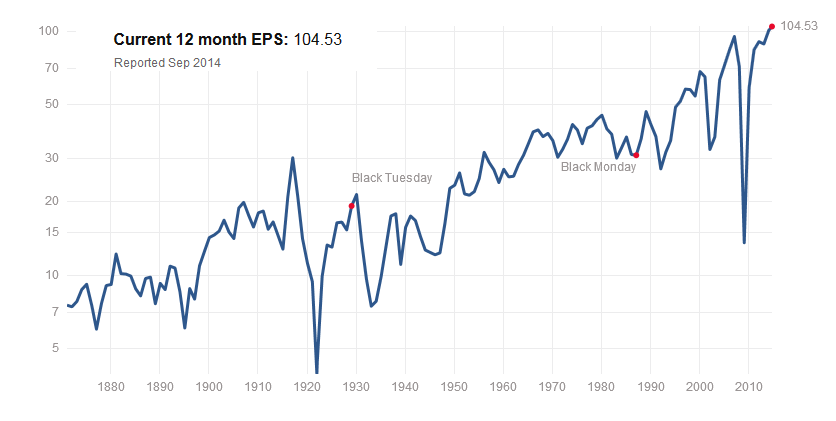

I'm looking all the way back to 1870 and instead of seeing a

harbinger of destruction, I'm seeing business as usual.

I'm looking all the way back to 1870 and instead of seeing a

harbinger of destruction, I'm seeing business as usual.

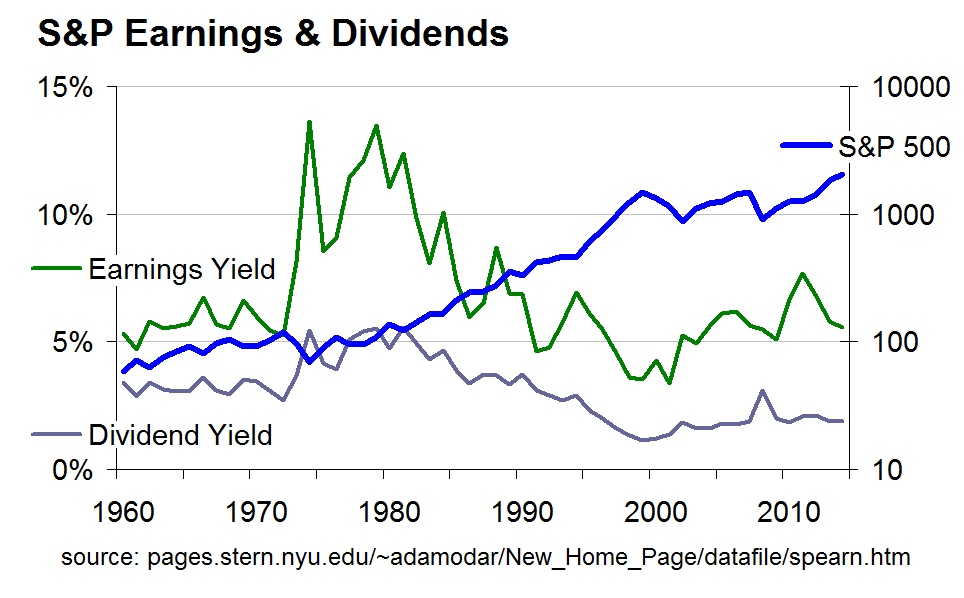

Got to love how we got all the facts here and the facts on stock valuations usually go to both earnings and dividends, and the way they relate to over all market stock prices.

Our friends at NYU got a site where we can download S&P500

earnings'n'dividend stats back to 1960 and imho there's food for

thought. Then again, I would have proffered some magic indicator

proving with all certainty that the market's going up or the

market's going down.

It don't work that way.

Maybe we're back to seeing Mirhaydari as being right after all. Maybe not w/ the doom'n'gloom shtick, but with the idea that it's good advice to "embrace a more defensive posture including long bets on volatility". Or as IBD calls it, we got a yellow light that means 'proceed with caution'.

Then again, I can't remember ever wanting to invest in any other manner...

* * * * * * * * * * * * * * * * * *

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |