| % above avg. months | % times the following year is above avg. | % times month predicts following year | |||

| January | 55% | 66% | 59% | ||

| February | 48% | 66% | 55% | ||

| March | 60% | 66% | 56% | ||

| April | 53% | 62% | 55% | ||

| May | 47% | 63% | 60% | ||

| June | 44% | 62% | 53% | ||

| July | 57% | 63% | 55% | ||

| August | 59% | 62% | 55% | ||

| September | 38% | 62% | 49% | ||

| October | 51% | 66% | 51% | ||

| November | 56% | 62% | 57% | ||

| December | 67% | 64% | 58% | ||

| average | 53% | 64% | 55% | ||

That's nice, but let's do our own thinking.

On the left is what we get when we look at the Dow Jones average monthly change for each month since 1896 and compare the month's performance with the total returns for the subsequent 12 months. The idea is to see if January is any better at predicting the up comming year any better than say February or March or...

What we end up with is the fact that most months are up, most years are up so

most months predict the following year. Since 1896 January has in fact predicted

better than most, but our winner turns out to be May which is right 60%

of the time vs. January's 59% score.

predict the following year. Since 1896 January has in fact predicted

better than most, but our winner turns out to be May which is right 60%

of the time vs. January's 59% score.

* * * * * * *

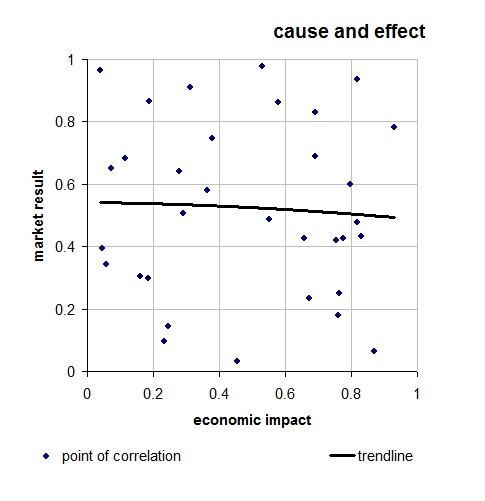

My personal take is that this is random and the problem we face is that it's sooo easy to see trends in purely random numbers. Check out the plot on the right of how an imaginary econ impact can affect my imaginary market. We end up with a trend line that slopes slightly downward. We could even exaggerate the scale and use it to "prove" a correlation.

My point is that all the numbers plotted there are random, and random numbers can always slow some kind of trend line. What's not random though is that people are productive and over the years they create wealth and if we invest in them we get rich. I can live with that.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |