What Oil Shock and Repub. Cave Mean to Stocks and GDP; Investment & Finance Thread - Dec. 14

So while nobody knows the future we still need to know what to expect from the week's two big headlines, even though our view can easily (and will probably) be muddied w/ other factors. So we deal with an unknown future by checking the historical record for clues on at what the news means to our future investment returns.

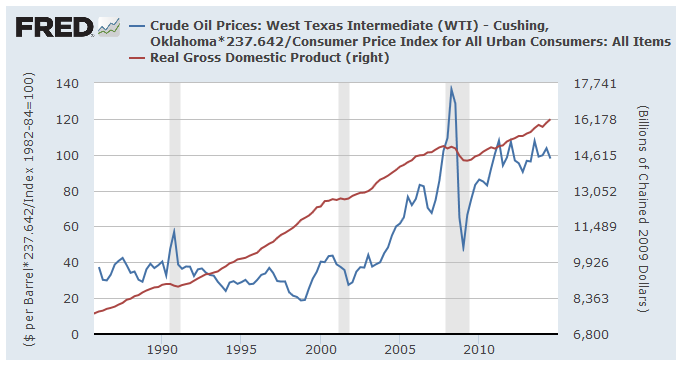

What oil bargains do: namely, what's it doing to the economy and to investments; here's what tanking oil's done in the past (ya gotta LOVE the fed's data site) and how real oil prices (2014$ per barrel) track real GDP--

[click to enlarge]

--and what we got is that it's the oil price surge that precedes a recession while crashing oil is what comes to the rescue afterword. True, there's more to econ growth than oil (wars and stuff) and sometimes econ growth can launch oil prices right back into orbit. Just the same, cyclical economic patterns come and go. We deal with it.

I n

the mean time right now we got $60 oil and we're wondering about what that means

for our 2015 investment returns. That track record's next on the

right:

n

the mean time right now we got $60 oil and we're wondering about what that means

for our 2015 investment returns. That track record's next on the

right:

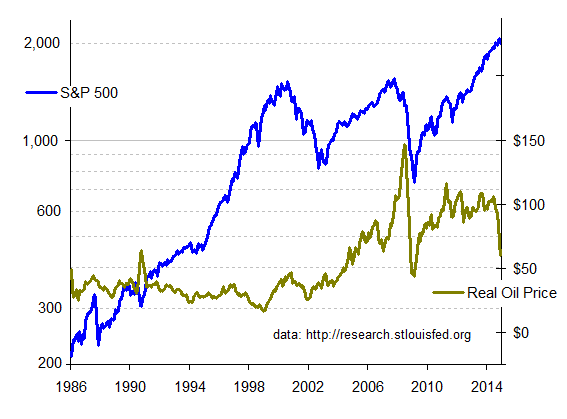

Someone please tell me if they're seeing something that I'm missing, but I believe I'm getting the same thing for stocks as w/ GDP. Namely, that a price surge is what tanks stocks and an oil price plunge (or prolonged era of low prices) does quite well thank you.

My first glance made me sing the old "...but this time is different..." tune because of how "this time" we've just been having several years of rising stock prices. My problem is that I'd been looking at this graph --with the S&P on a linear plot. In stocks we care about our gains --what percent we're doing now. A log plot shows percent increases better, so using the log plot at the right we can ask what a few years of $40 oil will do, and look at the long term oil price decline from Reagan thru Clinton. It made great gains even better.

Until the '99 oil rally that is, and then we had a dot.com bust. Still, I personally wouldn't mind another five years of super gains, even w/ another dot.com at the end.

More tax'n'spending: --and the other big headline being the fact that the House caved and gave the budget busters everything they wanted and the big question is what has this done in the past.

Answer: nothing.

OK, so why nothing? The answer is that (w/ few rare exceptions) the extreme left has controlled taxes & spending pretty much continuously for decades and that there's no way of seeing how a few years of budget restraint could have affected GDP and stocks. Sure, we know that big tax cuts (for those that remember that far back) did wonders for our personal lives and our ability to save and invest. We also know how increased investment w/ lower costs affect business activity. It might happen in the future and we can simply agree it would be great. It's not happening now, it hasn't happened before, and we're still here. We need to remember the enormous economic power of the American people and how we can build and prosper even during loooong stretches of abysmal government leadership.

In the meantime right now stocks are crashing ("market under pressure") and metals are continuing a month of solid gains. That can change.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

h/t to Lurkina.n.Learnin for asking us this question (here).