Investment

& Finance Thread November Rally Progress Report

Great time for investing! Gold & silver have been recovering for a

couple weeks now and a stock index rally is already in it's sixth week.

What's next --can it last? Pundits (as usual) are covering all sides, so

anyone wanting to indulge their confirmation bias need only pick their favorite

flavor op-ed:

Looking at the new stock highs we want to know two things: first is the surge

normal, and second is the increase out of proportion to company earnings and

dividends.

So

lots of folks check out the ratio gotten by dividing stock prices by their

earnings (Price/Earnings Ratios) or by dividing stock dividends by stock prices

to get a dividend yield percentages. Forget the pundits, they get it

wrong. In fact,

here's Obama saying PE's were bullish (he miss pronounced it as 'profit

earnings ratio') at the very time they were spiking to an all time bearish.

So

lots of folks check out the ratio gotten by dividing stock prices by their

earnings (Price/Earnings Ratios) or by dividing stock dividends by stock prices

to get a dividend yield percentages. Forget the pundits, they get it

wrong. In fact,

here's Obama saying PE's were bullish (he miss pronounced it as 'profit

earnings ratio') at the very time they were spiking to an all time bearish.

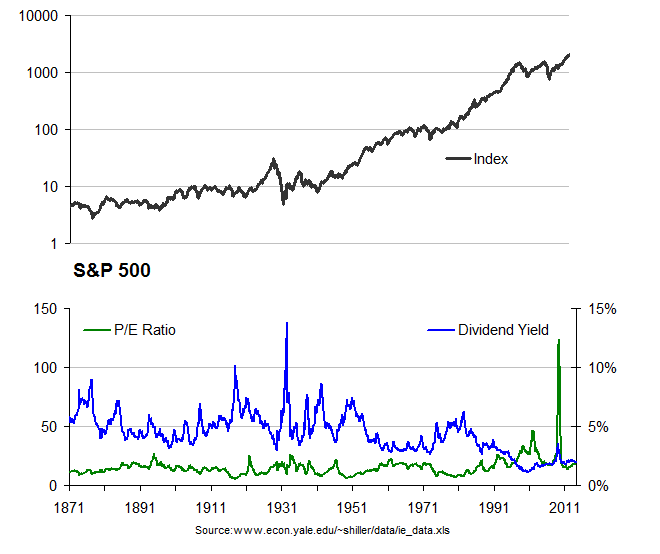

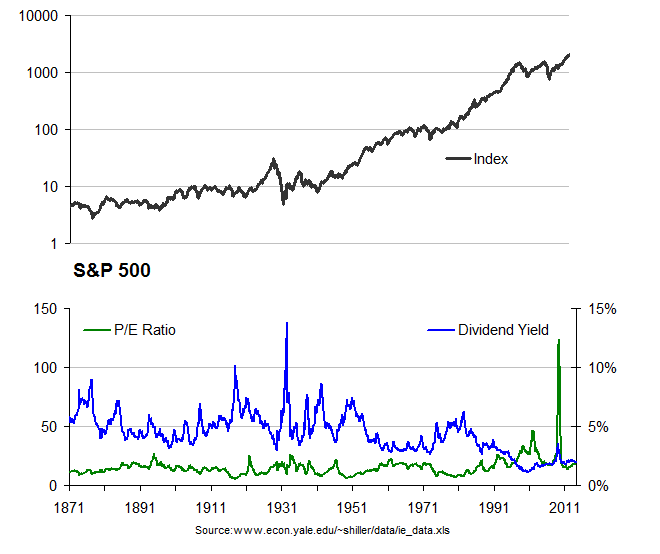

These days anyone can get stats going back over a century --here's

a link to Bob

Shiller's site at Yale w/ S&P valuations from 1871. A plot of the

index plus PE and div yield looks like the graph on the right (click to

enlarge), and going back over all the data kind of shows the idea that when

stocks are cheap the PE goes down and the dividends look big. OK, some of the

time they show that.

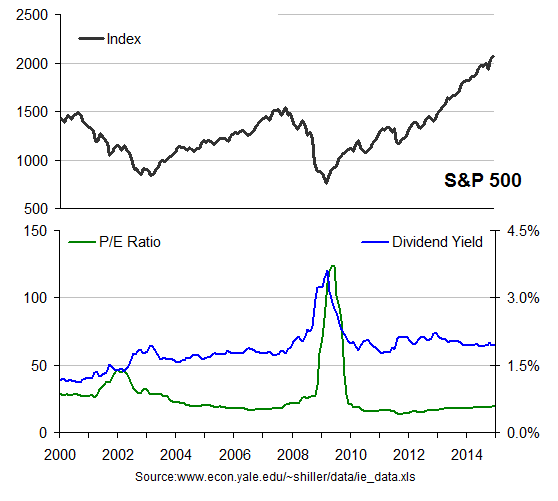

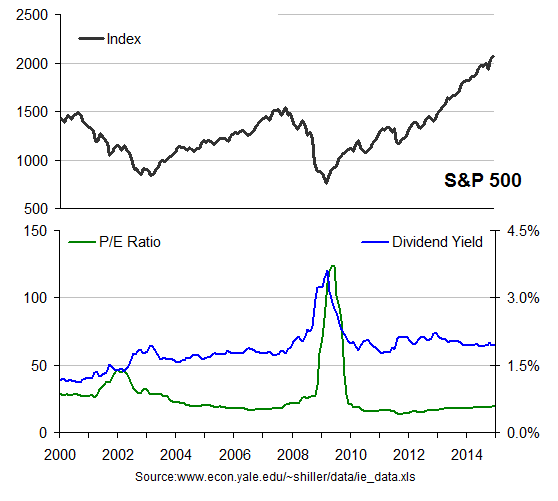

However, nobody here is managing his life savings over a 143-year time frame so

lets zoom in on the past 14 years:

Doesn't matter what the pundits say, the numbers are not telling us stocks are

over priced. Valuation prices are right where they were at the beginning

of 2008. Bad example. They're right where they were in the beginning

of 2004.

* * *

Bottom line here is that our upcoming Thanksgiving Day we can add this rally

to our long list of things we're grateful for. Since the whole idea of

flavoring wine w/ toast (hence "toasting") began around the time of the first

Thanksgiving Day, my extended family celebration will most probably begin the

meal with a shared toast "...to all that has come to pass!"

Happy Thanksgiving all!

So

lots of folks check out the ratio gotten by dividing stock prices by their

earnings (Price/Earnings Ratios) or by dividing stock dividends by stock prices

to get a dividend yield percentages. Forget the pundits, they get it

wrong. In fact,

here's Obama saying PE's were bullish (he miss pronounced it as 'profit

earnings ratio') at the very time they were spiking to an all time bearish.

So

lots of folks check out the ratio gotten by dividing stock prices by their

earnings (Price/Earnings Ratios) or by dividing stock dividends by stock prices

to get a dividend yield percentages. Forget the pundits, they get it

wrong. In fact,

here's Obama saying PE's were bullish (he miss pronounced it as 'profit

earnings ratio') at the very time they were spiking to an all time bearish.