Investment

& Finance Week Ending Nov. 16, 2014 --NOTHING HAPPENED!!

Investment

& Finance Week Ending Nov. 16, 2014 --NOTHING HAPPENED!!

Investment

& Finance Week Ending Nov. 16, 2014 --NOTHING HAPPENED!!

Investment

& Finance Week Ending Nov. 16, 2014 --NOTHING HAPPENED!!

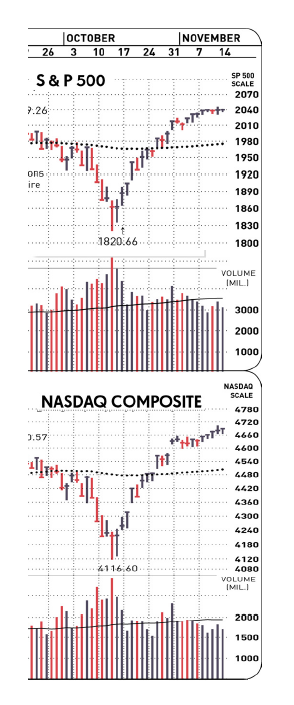

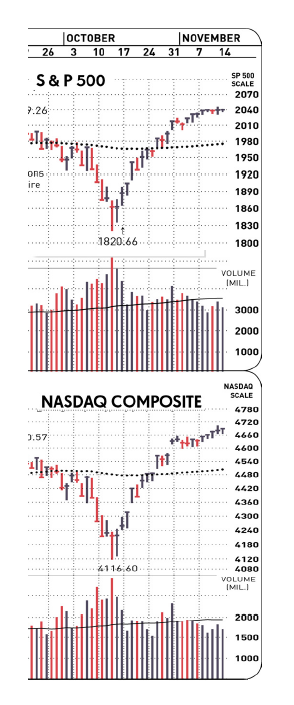

Investor's Business Daily said it well with their headline: "Stocks Wrap Up

Do-Nothing Week With More Small Gains". For both S&P and NASDAQ this

week's been tepid gains w/ falling volume Key question is whether

we're looking at a top or not, and that's where analysts cite "quite volume" and

"the di stribution

count remains low" (re "How

To Tell An Uptrend In Stocks Is All But Over"). On the

other hand (as they used to

tell Truman) if we look at where we were a couple weeks into the last two

tops (June 20 and Sept. 5), we see this very same low volume and distribution

count.

stribution

count remains low" (re "How

To Tell An Uptrend In Stocks Is All But Over"). On the

other hand (as they used to

tell Truman) if we look at where we were a couple weeks into the last two

tops (June 20 and Sept. 5), we see this very same low volume and distribution

count.

[Note to myself; time to pick positions I need close sooner & not later...]

Just the same on the other hand (what, I already said that?) this time we've also got the Washington cliffhanger. I mean, rumors aside to date there's been no big concessions, sneak thru's, cave-in's or blow-outs. iow we've just been though a soap-opera-like plot where they drag out of all the unresolved issues that we thought were hitting the fan last week.

It's almost like Congress is waiting to pass everything 3AM Christmas morning or something. Again. Whatever they do it ought to affect not only stocks, interest rates, real estate, and metals/commodities too (imho). The reasoning being that they've been tracking flat for a bit too. Fer instance, take my gold & silver. (Please.)* The jump they had for the past few days (back up over $1150 and $16 respectively) in all honesty is looking much more like a 'pause-while-plunging' then any 'serious-rebound-building'.

On the other hand things are not always what they appear to be.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

*rim shot