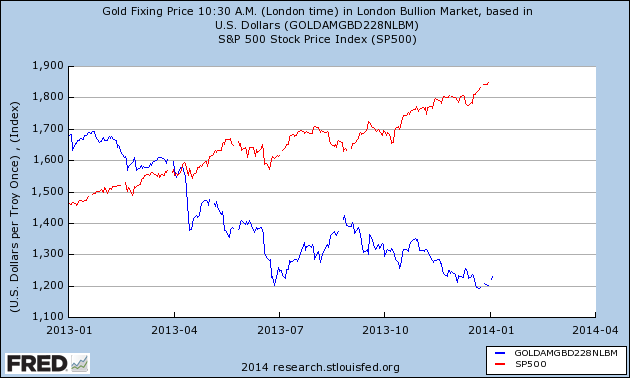

2013 was an amazing year-- stocks up 30%+ w/ metals tanking like 40%. Don't know about you but I spent most of it ready to bail out of stocks finding I never had a good reason. OK, so we made money but I'll be the first confess of being too cautious & missing out on some of the gains I should have gotten.

New Year's Resolution #1: No more wimping.

Sure, lots of folks are complaining about this past year's stock gains saying it can't last. The thing is that though we've been having a great run on stocks we can't expect it to last forever---

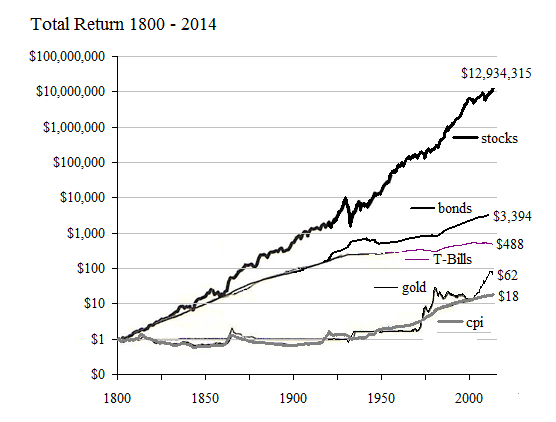

--because the fact that it's been going on for hundreds of years means that stocks are sure to revert to where they were in 1799 any second now.

Actually, no.

Stock returns are a function of the value of American commerce. America grows. We need to get used to it.

The long term pattern is total return on stocks since 1800 has been 8%/year-- that comes out to doubling our money in just over a dozen years.

On average.

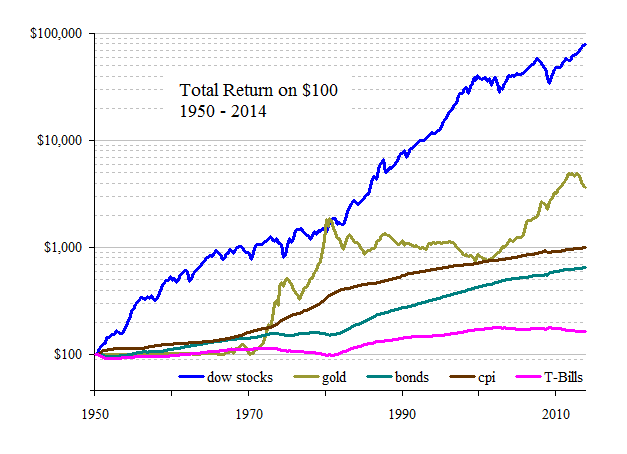

Looking more closely at the past few decades what I'm seeing is the fact that we're apparently leaving the stock perch we've been on for the past decade and a half, and we're seem to be emerging into what a lot of people call a 'secular bull market'.

OK, I'm still ready to dump if what I got drops 9%, but I'll put more effort into really checking before I post my sell order...