(excerpt

from)

(excerpt

from) Something weird is going on in the US economy, and it's not good

...Despite experiencing a healthy pace of job growth, the US economy has largely disappointed economists' expectations by delivering a series of weaker-than-expected economic reports.The unexpected plunges in retail sales and durable goods orders stand out as they reflect weakness in both consumers and businesses.

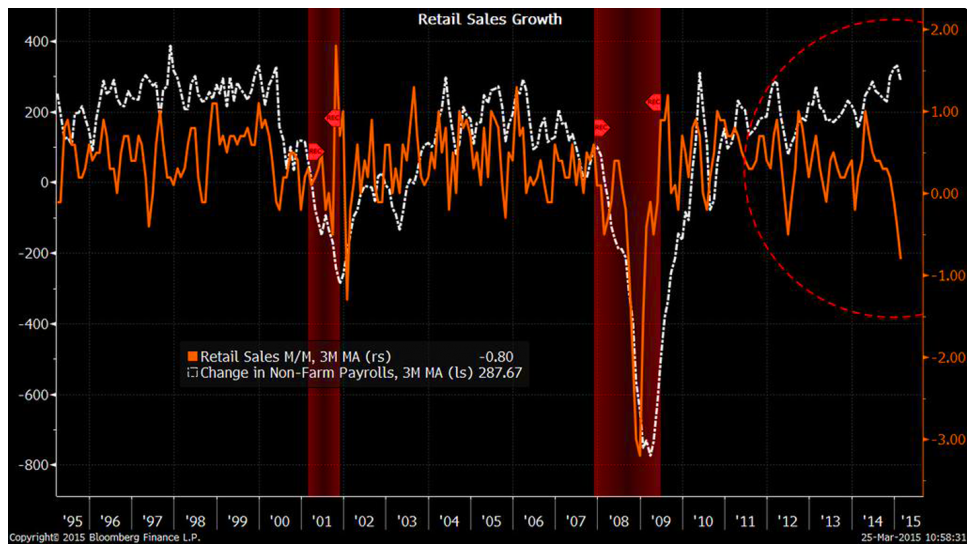

On Wednesday, Bloomberg LP Chief Economist Michael McDonough tweeted a chart of the unprecedented divergence between job growth and retail sales growth. This is concerning as personal consumption accounts for roughly 70% of US GDP.

It's particularly concerning considering all of the extra spending money Americans supposedly have thanks to falling gas prices.

"Recent US data have been disappointing," Goldman Sachs Kris Dawsey said late Thursday. Dawsey thinks GDP growth could tumble to 1.4% in Q1 from 2.2% growth in Q4 of last year. Economists had previously expected GDP growth to accelerate in Q1 to around 3%.

Q2

Comeback?

For the most part, economists have attributed much of the recent

weakness to unusually harsh winter weather and the plunge in oil prices,

which has slammed the spending plans of US drillers. For this reason,

economists are optimistic that weakness in Q1 could be offset by a

rebound in Q2.

Dawsey specifically sees three reasons to be bullish on Q2:

Consumers will bounce back: "While some of this output may be lost for good (i.e. people won't eat two restaurant meals the next time they go out to make up for snow-delayed date night), a simple bounce-back to the prior level of spending would boost the growth rate in Q2 by roughly the same amount as the Q1 drag. In addition, some of the activity may just be shifted into Q2, in particular with regard to residential investment, resulting in an even bigger potential boost."

Energy companies will bounce back...

[snip]

Gas savings will fuel spending...

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy.

--is that (1) this "weird" stuff really is happening, (2) but not the way BI said, and (3) it's actually a good thing.

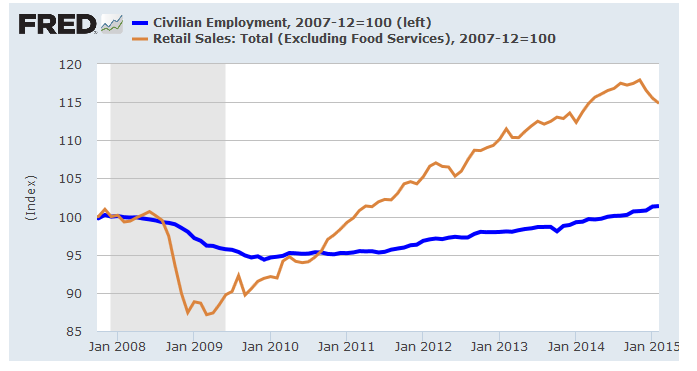

In the first place BI's numbers are real and true. However the article uses them to support the belief that we got "...plunges in retail sales... ...the unprecedented divergence between job growth and retail sales growth." Reality is that for years now we've not seen falling sales and rising employment, we've had falling employment and climbing sales.

The 'misunderstanding' (a kind way of saying "deceit") was caused by allowing monthly changes in jobs'n'sales to pass for what's really going on with jobs'n'sales. Reality is that the actual cumulative increase in sales since the recession, is really a 15% climb, while total employment's dragged up a meager one percent. Job stagnation looks even worse when we take into account population growth over the period --17 million more people is a 6% expansion that shows how our 1% employment increase is truly inadequate.

But we digress.

But as long as we're digressing how about we also remember that this so-called 15% boom in sales ignores inflation and population growth. Taking those factors into account we find that real per capita sales is down 5% from the pre-recession high and remember that for decades Americans had been enjoying continuous sales growth--

OK so the economy sucks but that's still not the point. The BI writer (he holds a BA in Religion from Boston University) screwed up by passing on the idea that the drop in sales was an "unprecedented divergence" along with a the graphic that circled an era going back years. Coming back to the Planet Earth the divergence that we do have does not span "years". It's been going on now more like for a couple months. Hey, remember that everyone says "size doesn't matter" so let's be happy with what we got because there're a number of reasons why falling sales and rising employment can even be good for us.

For starters it means that people are getting back to work and they're saving for hard times ahead. Americans. Ya can't beat 'em.

Another reason is that the past few years of stagnant jobs and rising sales has only been possible because of the rise of spending by the elite wealthy. Whoa --we're not going into some goofy income inequality shtick because equal incomes is what Marx advocated. Bad idea. Our problem is that until recently the risk has been a separation between the rich and poor --an opportunity deficit that threatened to close the book on America's success stories. These past few months offer reassurance that wealth class structure is not that solid after all.

Finally my take is that at the very least falling sales --while short term pain-- can be a 'wake-up-call' for the policy wonks that don't know or don't want admit the economy sucks.

They might even get off our backs and let us get back to work...