The main reason we try to predict markets is so afterward we can gloat saying we knew it all along. Easy-peasy -- all we do is predict doom'n'gloom and eventually asset prices will sag. Sure, most of the time prices go up, things grow and wealth is created, but the only time folks cry WHY!!?? is during the rough times.

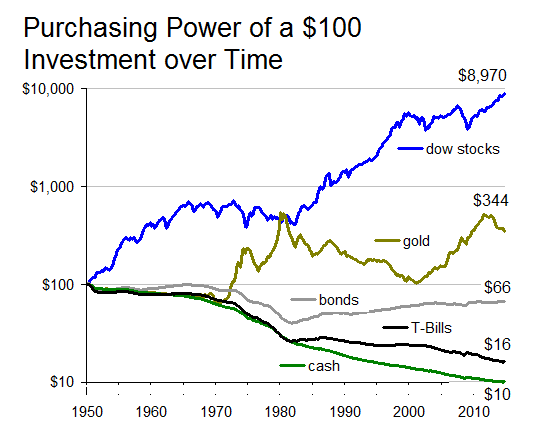

Then again, the other reason we figure out expected market trends is so we can make money. That's not that hard either because over time most investments do better than say, cramming bux in a mattress (first graph left). Then we get to the fact that not all types of investments are created equal, and various types of investments' eventual purchasing powers behave differently. My favorite's stocks, though there have been time periods when some of us have done even better w/ precious metals. Note that real estate, collectables, etc., are not being mentioned here because of the constraints of I don't want to.

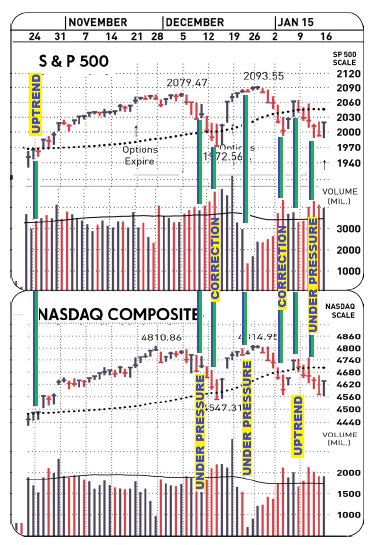

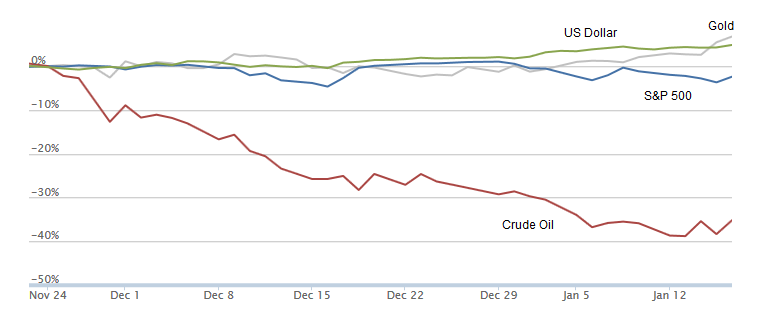

Long term over-the-decades is all well and good, but hey we also

would like to see some good happening say, day by day or at least month by

month. There's the rub; the past couple months have been crazy (graph

right) what w/ tanking oil and sideways roller-coasters for everything else.

I mean, usually when we spend a bit of time going over index charts we get

patterns we can work with. Take IBD's market calls.

what w/ tanking oil and sideways roller-coasters for everything else.

I mean, usually when we spend a bit of time going over index charts we get

patterns we can work with. Take IBD's market calls.

Please.

Years of research enabled them to correctly call the nifty run-up we all enjoyed last November (second graph left). That was then and for the past month all those formally dependable signals have suddenly gone into mid-life crisis.

Rule Number One though is to accept things as they are, and if we got chaos then we got chaos. Everyone's got their own favorite way of muddling through times like these; my personal favorite calls back to the old oriental counsel going something like if you're going to be savagely attacked and beaten and there's nothing you can do about it you may as well just relax and enjoy it.

iow, there's a lot to be said for the "don't just do something, stand there" approach --AKA wait and see and be good w/ it.

* * * * * * * * *

|

Top 10 reasons that us FR investors want to participate in the 2015 Q1 FReepathon:

--and here's my favorite: 1. On the internet, when you're getting something you're not paying for, then you're not a customer. You're a product. |

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |