December/year-end

Markets;

Investment

& Finance Thread

December/year-end

Markets;

Investment

& Finance Thread

December/year-end

Markets;

Investment

& Finance Thread

December/year-end

Markets;

Investment

& Finance Thread

Once again we can say we're looking at a great time for investing! OK, so it means we wince over last Friday's metals prices, but like who does metals anyway dude, like it's soooo 2013 even. That and the general feeling we get reading stuff like Gold mining industry mostly ‘under water’ – Gold Fields CEO (h/t Chgogal).

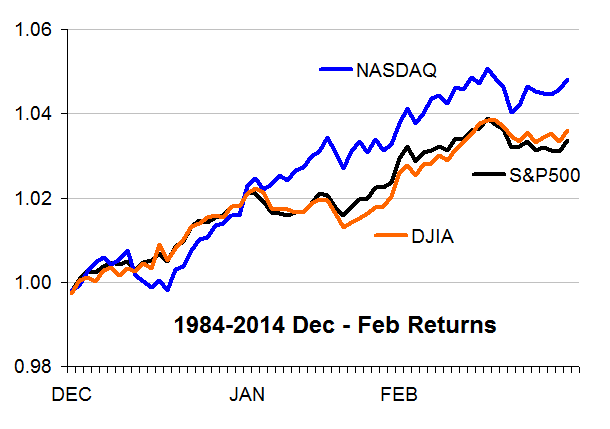

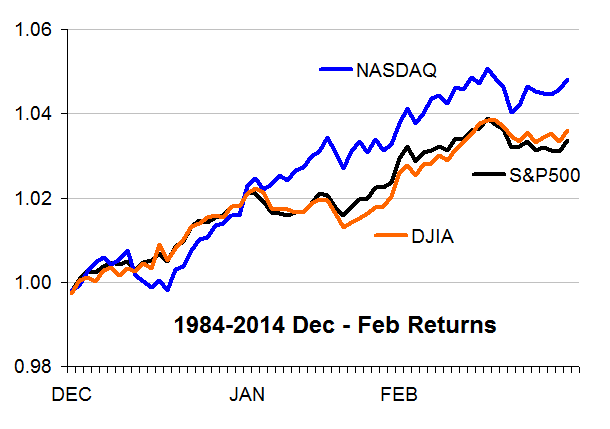

Hey, I'm talking stock market year end "window dressing"† January effect --check out the averages over the past 30 years for the Dow, S&P500, and the NASDAQ, they typically go up 3.4%, 3.6% and 4.8% respectively. On top of that these are for just 3 months and it translates to annualized returns of 15%, 14% and 21%!

Only thing we could hope for is that we're looking at an average year --problem is that the reason this time it's different is becuase it's always different. The plots on the right (click to enlarge) show how the stellar year-end trends look compared to what the 30-year extremes have been. Sure, the past 3 decades includes the 2009 Inaugaration Grand Market Crash that was in all the papers, but still we all know that we can't just buy and expect any guarantees here.

That said yours truly is cautiously moving back in w/ one hand while the other hand's holding on to the ejection seat lever. Stay calm. Remember that the new congress takes office in the latter part of Jan. and they won't be able to have any actual impact until weeks later. At the same time we know the President has already gotten middleeast-defeat, amnesty, Ferguson, and obabacare-defiance completely out of his system so that there's nothing down the pike that he might toss out that can possibly be any worse....

† "window dressing" is when institutional traders clean up their portfolios at year's end w/ pop darlings bought w/ cash from dumping the bow-wows --the idea being they want the annual report to look better.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |