Investment

& Finance Thread Market Rally Progress Report

Investment

& Finance Thread Market Rally Progress Report

Investment

& Finance Thread Market Rally Progress Report

Investment

& Finance Thread Market Rally Progress Report

Stocks are up and metals are down.

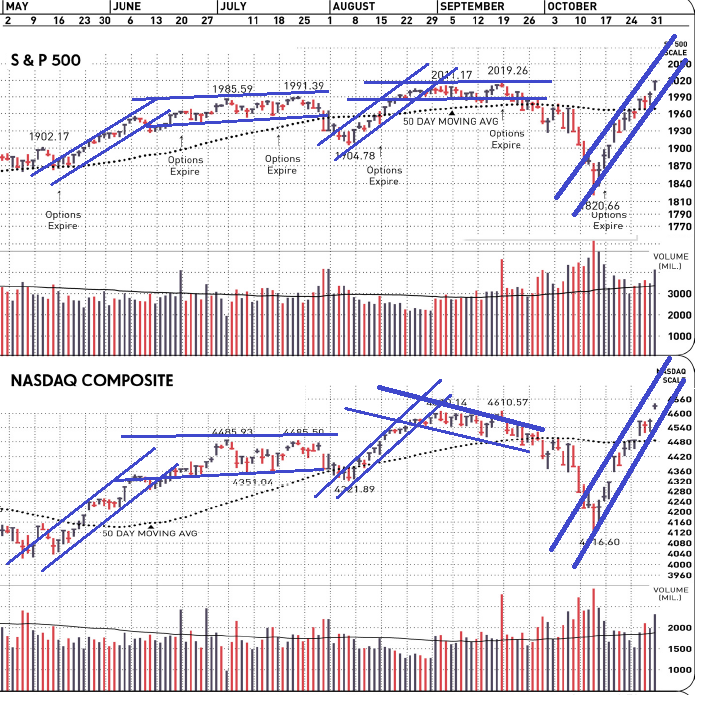

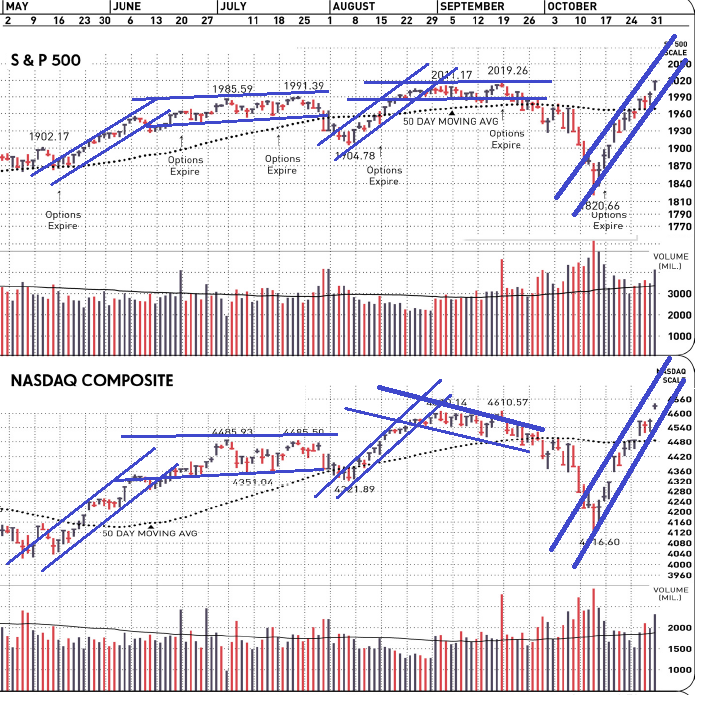

Details: major stock indexes have been showing a run up for the past three weeks --enough time to look at trading patterns. The past two uptrends (w/ both the NASDAQ and the S&P500) seemed to come in two parts, a 3-4 week burst followed by a month & a half stalling before the drop off. OK, so there's no law that says the current run-up has to follow suit but what we know is that for the next week prices within the trendlines are "business as usual".

Not much help from the pundits because they're taking all sides.

Makes it difficult to get good input either in the form of sage advice or as a stupid-pundit

contrarian indicator.

|

Stocks Zoom, Confirming Moriciís Prediction

I have written that the

fundamentals of capital formation and stock market valuations have changed, and

indicate stocks are capable of maintaining a much higher P/E ratio than that

historical average going forward. U.S. Recovery Is the Envy Of the World - Chico Harlan, Washington Post Obama's Incompetence Explains The Poor Recovery - Editorial, Investor's Latest Rebound Says Bear Isn't In the Cards - Mark Hulbert, MarketWatch The World's Richest Are Bullish On the U.S. - Margaret Collins, Bloomberg |

As for metals the chaotic downtrends show few repeating patterns, so we're still looking at a decline that began at the 2011 top. If anyone sees a decent pattern they're sure welcome to MicrosoftPaint some trendlines and share.

In the mean time let's see what Tuesday's elections do --remembering that Democrat surprise victories were followed by 10 - 20% stock losses.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |